turn your dreams into action with a KCCU home equity loan

As a homeowner, you can use your home's equity to finance virtually anything and turn your dreams into action!

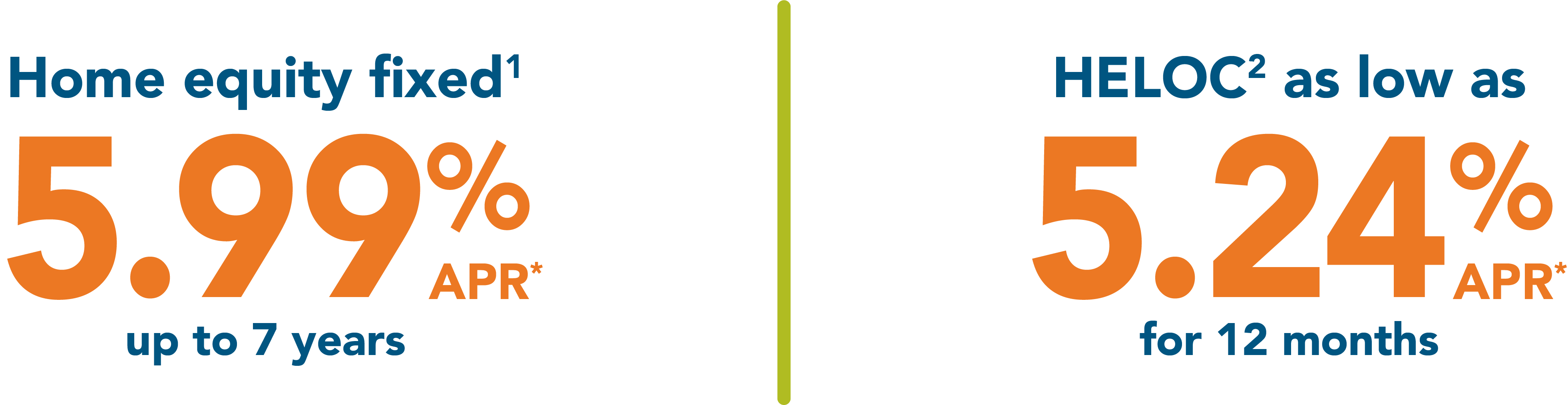

Our fixed rate home equity loan allows your to borrow a lump sum of money that is repaid over a fixed period. We also offer a home equity line-of-credit (HELOC), where borrowers can use the line-of-credit as needed for purchases, and the good news is you only pay interest on what you actually borrow!

choose the one that is right for you!

With KCCU's great low rates, convenient terms, and fast turnaround on home equity loans, now is the time to:

- consolidate high-interest debt

- make home improvements

- plan your dream vacation

- pay college tuition

- cover major expenses

- and more!

how to get a home equity loan

Or, simply stop in at any of our branches or call a Member Service Representative at 269.968.9251. Interested in a home mortgage, real estate loan, or mortgage refinancing see our mortgage lending page.

*APR=Annual Percentage Rate. Rates effective 7/31/2024. Limited time offer for new loans to KCCU. Loan programs, rates, terms, and conditions subject to change without notice. All loans subject to credit approval, term, and collateral. Best rate available to qualified borrowers under 80% Loan to Value (LTV) and with a minimum credit score of 730. Other restrictions and fees may apply. NMLS# 585521.

1 Promotional rate as low as 5.99% APR for terms up to 7 years. Your rate may be higher based on your collateral, term, and credit score. Other rates and terms available. With a 7-year fixed home equity loan, for each $1,000 borrowed, 84 monthly payments of $14.60. Payments do not include mortgage insurance premiums.

2 Promotional, introductory APR applies only to new HELOCs. The plan will convert to variable rate after the first 12 months. The APR is based on the WSJ prime rate (currently 8.50%) plus margin and may adjust monthly. After the introductory period, the APR can range from 3.25% to 18.00%. The maximum APR that can be imposed is 18%. Approval and rate may vary based on credit, term and security offered. Interest only payments during 5-year draw period with 15-year repayment of principal and interest. Other restrictions may apply.

open

open apply

apply submit

submit calculate

calculate