The KCCU Blog

Tax season can feel overwhelming, but with the right preparation, it doesn’t have to be stressful. Staying organized and starting early can help you avoid mistakes, reduce anxiety, and potentially maximize your refund. Use this tax season checklist to make sure you are fully prepared.

1. Gather Personal Information

- Social Security numbers or Tax Identification Numbers for you, your spouse, and dependents

- Dates of birth for everyone listed on your return

- Your previous year’s tax return for reference

2. Collect Income Documents

Gather all documents that report income earned during the year. These may include:

- W-2 forms from employees

- 1099 forms for freelance, contract, or other non-employee income

- 1099-INT or 1099-DIV for interest and dividends

- 1099-R for retirement distributions

- Records of rental income or other miscellaneous income

3. Organize Expense Records

If you plan to itemize deductions or claim credits, collect documentation for eligible expenses, such as:

- Mortgage interest statements

- Property tax statements

- Charitable donation receipts

- Medical expense records

- Education expenses and tuition statements

4. Review Tax Credits and Deductions

Consider whether you qualify for common tax credits and deductions, including:

- Child Tax Credit

- Earned Income Tax Credit

- Education credits

- Retirement savings contributions credit

- Energy-efficient home improvement credits

5. Prepare Business or Self-Employment Records

If you are self-employed or own a small business, gather:

- Income and expense records

- Mileage logs

- Receipts for business-related purchases

- Home office expense documentation

- Quarterly estimated tax payment records

6. Verify Bank Information

If you are expecting a refund or plan to pay electronically, confirm your bank account and routing numbers to avoid processing delays.

7. Check Important Deadlines

Mark important tax deadlines on your calendar. Filing late can result in penalties and interest. If you need more time, consider filing for an extension before the due date.

8. Choose How You Will File

Decide whether you will:

- File your taxes using tax software

- Work with a certified tax professional

- Use free filing options if you qualify

9. Review Before Submitting

Before submitting your return, carefully review:

- Names and Social Security numbers

- Income amounts

- Deductions and credits claimed

- Bank account details

10. Keep Copies of Everything

After filing, keep copies of your tax return and all supporting documents in a secure location. These records may be needed for future reference or in case of an audit.

Final Thoughts

Tax season does not have to be complicated. By following this checklist and staying organized throughout the year, you can approach tax filing with confidence and peace of mind.

February, the month for boxed chocolates, red roses, and romance. Yes, love indeed scatters itself through the air, especially during this time of year, but one kind of “romance” is always on the prowl: online romance scams. As human beings, we crave connection, safety, and trust. At first, an online romance scam may seem like it checks all three of these boxes, but in reality, the only connection they’re seeking is money from your bank account being transferred to theirs. According to Eyewitness News, the FBI reported more than $635 million was lost to online romance scams in 2025, indicating a substantial amount of victims were affected. At KCCU, we want our members’ hearts and wallets protected from those who attempt to seek advantage. We’re here to help point out all the signs of an online romance scam, from start to finish.

In this blog, we’ll break down what online romance scams are, how they operate, warning signs to watch for, and practical steps to protect yourself and loved ones. If you use dating apps, social networks, or messenger platforms, this guide is essential reading.

What Are Online Romance Scams?

An online romance scam occurs when a fraudster creates a fake identity to pursue a romantic relationship with someone online with the ultimate goal of obtaining money, personal information, or both. Unlike other scams that might be one-off transactions, these cons build emotional bonds first and then exploit them.

Scammers typically initiate contact through dating sites, social networking platforms, or messaging apps. Over time, they cultivate what appears to be a genuine emotional connection, then gradually introduce financial requests under various pretenses.

Why Romance Scams Work

Romance scams succeed because they manipulate basic human needs: love, affection, loneliness, and trust. Many victims are seeking companionship and may be more open to expressions of love and emotional support. Scammers exploit these vulnerabilities by mirroring desires - flattering, supportive, and engaging consistently until the victim begins to trust them.

Once trust is established, the requests for money or help don’t sound like demands, they sound like needs of someone you care about.

How Scammers Build the Illusion of Love

A common thread in these schemes is emotional investment. Here’s a typical sequence:

- Initial Contact

The scammer sends a message or friend request, sometimes triggered by a profile that seems ideal for each other. - Rapid Emotional Intimacy

Without ever meeting in person, they express affection quickly, often using phrases like “I think I’ve found my soulmate in you.” - Frequent Communication

They message daily, sometimes hourly, to establish a sense of closeness and routine. - Isolation Tactics

They encourage the victim to keep the relationship private to avoid questioning from friends and family. - Fabricated Crises or Needs

Once trust is strong, they request financial help: to pay a medical bill, travel expenses, legal fees, or unexpected emergencies. - Refusal to Meet in Person

When asked to video chat or meet, they invent reasons, travel schedules, work obligations, cultural norms, designed to avoid verification of identity.

By orchestrating emotional dependence and gradual escalation, scammers make their requests seem legitimate.

Common Scenarios and Excuses

Scammers will deploy a variety of stories. Some of the most common include:

- Emergency medical situation — “I have no money to pay my doctor.”

- Travel delay or problems at the border — “I need cash to get my passport back.”

- Job or business investment opportunity — “This will secure our future.”

- Family crisis — “My child is sick.”

In each case, the scenario is designed to evoke empathy and urgency.

Who Gets Targeted? It’s Broader Than You Think

While scammers can target anyone, certain factors increase vulnerability:

- People seeking companionship after loss or divorce

- Individuals isolated by geography, disability, or circumstance

- Older adults who may be less familiar with digital communication

- Users of niche dating platforms (military, religious, hobby-oriented) where assumed shared interests build trust faster

But even experienced internet users can be pulled in; these fraudsters are adept at psychology, persistence, and manipulation.

Financial and Emotional Impact

The financial losses from romance scams are staggering. In many countries, authorities report billions of dollars lost annually to online romance fraud. Scammers often extract money slowly to avoid suspicion, perhaps sending multiple smaller requests that add up over time.

The emotional toll can be even deeper:

- Shame and embarrassment at being deceived

- Trust issues with future relationships

- Isolation and withdrawal from social support networks

The deception doesn’t just take money; it undermines confidence and emotional well-being.

Red Flags: Spotting a Romance Scam

Recognizing a scam early can save both your heart and your finances. Here are common warning signs:

1. The Connection Happens Too Fast

They profess deep feelings early in the conversation after only a few days or weeks.

2. They Avoid Face-to-Face Verification

Repeated excuses for avoiding video calls or in-person meetings.

3. They Ask to Move Away From the Platform Quickly

Suggesting you switch to email, private messaging apps, or SMS before sufficient trust is built.

4. Their Photos Are Too Perfect

Pictures resemble professional models or appear syndicated across multiple profiles (reverse image search can reveal reuse).

5. They Request Money

Especially for emotional or personal crises.

6. Their Stories Don’t Add Up

Conflicting details or evasiveness about specific personal information.

7. They Claim to Be Abroad or Traveling Constantly

Frequent “international” explanations that make logistics implausible.

Protect Yourself: Practical Safety Tips

Here’s how you can protect yourself and others from romance scam situations:

Take It Slow: Meaningful connections take time. Don’t rush into deep emotional disclosures.

Verify Identity: Use video calls early in communication before trust becomes too strong to question.

Do a Reverse Image Search: This can reveal whether a photo is scraped from stock sites or someone else’s social media.

Never Send Money: No matter how compelling the story sounds. Once money is sent, it’s often impossible to recover.

Keep Communication on the Platform: Dating sites and apps often provide some level of monitoring and accountability.

Talk to Friends or Family: Independent perspectives often spot inconsistencies you might overlook.

Learn the Common Scammer Playbooks: Understanding typical tactics makes you less susceptible to manipulation.

What If You’ve Been Scammed? Steps to Take

- Cease all communication with the scammer.

- Report the profile to the platform.

- Report to relevant authorities

These reports help track patterns and protect others.- Federal Trade Commission (FTC): The main place to report identity theft, scams, and unethical business practices; they use reports for law enforcement.

- FBI’s Internet Crime Complaint Center: For all internet-enabled crimes, helping with investigations and fund recovery.

- Inform your bank or financial institutions immediately if you’ve transferred money.

- Talk to someone you trust — emotional support is crucial.

- Seek professional advice if necessary, especially if financial loss is significant.

Why Reporting Matters

Many victims don’t report scams due to shame or fear of judgment. But reporting is critical:

- It helps law enforcement track organized fraud rings.

- It can protect others from falling into the same trap.

- It contributes to public awareness and better safety practices on platforms.

Remember: the fault lies with the scammer, not the victim.

Final Thoughts: Love Isn’t a Scam, But Be Smart

Online romance scams are real, sophisticated, and emotionally wrenching. They prey on compassion and trust. But awareness is power. By understanding common tactics, recognizing red flags, and prioritizing safety, you can enjoy digital connections with confidence.

Love shouldn’t cost you your savings or your self-worth.

Stay informed. Stay cautious. And when in doubt, reach out for support. Your heart and wallet will be better off for it.

In today’s digital world, protecting your personal and financial information is more important than ever. From online banking to mobile apps and social media, our data is constantly in motion. At KCCU, your security is a top priority—and there are simple steps you can take to strengthen your own data privacy every day.

1. Use Strong, Unique Passwords

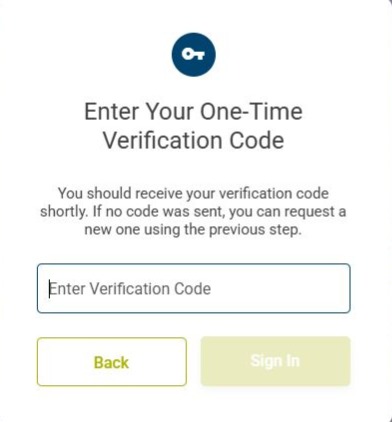

2. Enable Multi-Factor Authentication (MFA)

Whenever possible, turn on multi-factor authentication. This adds an extra layer of security by requiring a second verification step—such as a one-time code—before accessing your account.

3. Be Alert to Phishing Attempts

Fraudsters often pose as trusted organizations to trick you into sharing sensitive information. Be cautious with emails, texts, or calls that ask for personal or financial details. KCCU will never ask for your login credentials through unsolicited messages.

4. Keep Your Devices Updated

Regularly update your phone, computer, and apps. Updates often include important security patches that protect against the latest threats.

5. Review Privacy Settings

Check the privacy and security settings on your banking apps, social media, and other online services. Limit the amount of personal information you share publicly and only grant app permissions that are truly necessary.

6. Use Secure Networks

Avoid accessing financial accounts on public Wi-Fi. If you must use a public network, consider a trusted virtual private network (VPN) to encrypt your connection.

7. Monitor Your Accounts Regularly

Review your bank and credit card statements frequently. If you notice anything unusual, report it to KCCU immediately so action can be taken quickly.

8. Safely Dispose of Sensitive Information

Shred documents containing personal or financial details before discarding them. This simple habit can prevent identity theft.

Staying informed and proactive is one of the best ways to protect your data. By following these tips and partnering with KCCU’s commitment to security, you can bank with greater confidence and peace of mind.

If you believe your data privacy has been compromised, contact the following trusted sources promptly for assistance and guidance:

- Your Financial Institution (KCCU): Report suspicious activity or potential data exposure immediately so protective steps can be taken on your accounts.

- Federal Trade Commission (FTC): File an identity theft or data privacy complaint and get recovery guidance at IdentityTheft.gov.

- Credit Bureaus: Place a fraud alert or credit freeze with the major credit reporting agencies:

- Local Law Enforcement: File a police report if identity theft or financial fraud has occurred.

- Internal Revenue Service (IRS): Contact the IRS if you suspect tax-related identity theft.

Acting quickly and contacting the appropriate sources can help limit damage and protect your personal and financial information.

Safeguarding your personal and financial information requires consistent awareness and thoughtful action. By applying these practical strategies and knowing how to respond if concerns arise, you can better protect yourself from potential threats. Together with KCCU’s dedication to account security, these measures support a safer, more confident banking experience.

As the calendar turns and a new year begins, many of us set resolutions focused on health, happiness, and personal growth. This year, consider adding financial fitness to your list. According to the Pew Research Center, 40% of adults describe their current financial situation as fair, 17% as poor, and 28% expect their financial situation to worsen. Consequently, it is important to focus on developing a plan to keep your finances in check. Just like physical wellness, financial wellness is built through consistent habits, informed decisions, and the right support system. At KCCU, we believe a financially fit life helps you focus on what matters most.

What is Financial Fitness?

Financial fitness means having the knowledge, habits, and confidence to manage your money effectively. It’s about living within your means, preparing for the unexpected, and planning for your future—without constant stress. Whether you’re just starting out or refining your financial strategy, small steps can lead to big improvements.

Start with a Financial Check-Up

A new year is the perfect time to assess where you stand. Review your income, expenses, savings, and debt. Creating or updating a budget helps you see exactly where your money is going and where adjustments can be made. In return, you’ll start to feel much more in control of your finances. In the words of Dave Ramsey, “A budget is telling your money where to go instead of wondering where it went.” Think of it as your financial baseline for the year ahead.

Set Realistic, Achievable Goals

Instead of vague resolutions like “save more money,” aim for specific, measurable goals:

- Build or strengthen your emergency fund

- Pay down high-interest debt

- Save for a vacation, home, or major purchase

- Increase retirement or long-term savings

Clear goals keep you motivated and make progress easier to track.

Build Strong Financial Habits

Consistency is key to financial fitness. Automate savings, pay bills on time, and review your accounts regularly. Even small, regular contributions to savings can add up overtime. Developing these habits now can set you up for long-term success.

Use KCCU Tools and Resources

At KCCU, we’re here to support your financial journey. From savings accounts designed to help you grow your money to loans with competitive rates and personalized guidance, our team is committed to helping you make confident financial decisions. Along with our services designed to improve financial fitness, we offer a wide array of tools to help you become more knowledgeable and shape the steps you want to take next:

Financial Management & Learning Tools: KCCU partners with Zogo Finance, a gamified financial education platform that teaches money skills in bite-sized lessons. Members earn rewards like gift cards as they complete modules on topics from budgeting and saving to credit and retirement. This makes learning about money fun and rewarding.

There’s also Zogo Classroom, a platform tailored for educators to teach financial literacy to students — helping cultivate strong money habits early.

Calculators and Planning Tools: KCCU offers online financial calculators such as mortgage calculators, auto loan payment calculators, budget calculators, saving calculators, and more, that help members project outcomes and make informed decisions — for example:

- How much you’ll pay monthly on a loan

- How long it will take to pay off debt

- What your savings could grow to over time

- Mortgage and payment comparisons

These tools can help you map a path to your financial goals and better understand the impact of your choices.

Digital Banking: It’sMe247 Online Banking allows members to check balances, transfer funds, view statements, apply for loans, schedule automatic transfers, set up alerts, and much more — all from home or on the go.

The KCCU Mobile App puts full banking control in the palm of your hand. You can view account details, make mobile deposits, pay bills, transfer funds, apply for loans, and even control your debit/credit card settings.

These tools help members stay on top of their finances daily — a key part of financial fitness.

Credit Score Insights: Through SavvyMoney, KCCU members can access credit score information and educational resources to understand and monitor their credit — an important part of financial health.

Practical Support Tools: KCCU also provides forms and resources to help members efficiently manage their accounts and services — such as setting up direct deposit or automatic payments or loan payment instructions — so that transactional tasks don’t become barriers to staying financially organized.

Why This Matters for Your New Year’s Resolution

Financial fitness is more than saving; it’s about learning how to make smart financial decisions, tracking progress, and having the tools to act confidently toward your goals. KCCU’s suite of digital banking tools, educational platforms, calculators, and credit-building resources help you take control of your money and build habits that stick.

Make This the Year You Feel Financially Strong

Financial fitness isn’t about perfection, it’s about progress. This New Year, take control of your finances, one step at a time. With the right mindset and a trusted partner like KCCU by your side, you can make this your most financially fit year yet.

Ready to get started? Visit KCCU or connect with our team to learn how we can help you turn your financial goals into reality.

Kellogg Community Credit Union (KCCU) successfully concluded its annual holiday toy drive, helping ensure local children could experience the joy and excitement of the holidays. This year marked the 23rd consecutive year KCCU has proudly supported children in need through this meaningful tradition.

KCCU collaborated with the Salvation Army's Angel Tree program at its Battle Creek, Kalamazoo, and Grand Rapids branches. The Three Rivers branch and Schoolcraft branch partnered with the St. Joseph County United Way to support local foster children, while the Marshall branch worked alongside There's Enough. Thanks to the incredible generosity of KCCU members and staff, more than 800 toys were collected. These donations will make a lasting difference for many families and bring holiday cheer to children throughout the communities KCCU serves.

"The holidays are truly a magical time for children, but for many families, this season can also bring financial stress," said Tracy Miller, CEO of KCCU. "That's why this toy drive is so important to us - it allows us to come together as a credit union and as a community to help ensure every child can experience the joy and excitement of the season, while giving financial relief to those who need it most. Seeing the generosity of our members, team, and community partners year after year is incredibly heartwarming, and we are deeply grateful to everyone who helped make the holidays brighter for so many local children and families."

###

Kellogg Community Credit Union, headquartered in Battle Creek, Michigan is a full-service financial institution serving people who live, work, worship, or attend school in the state of Michigan. With $951 million in assets, KCCU proudly serves over 55,000 members in Michigan, with branches in Battle Creek, Marshall, Kalamazoo, Portage, Richland, Grand Rapids, Schoolcraft, and Three Rivers. A community leader since 1941, KCCU consistently outperforms other financial institutions with outstanding service satisfaction ratings and a long history of growth. For more information, please visit www.kccu4u.org. Connect with KCCU on Facebook, Instagram, and LinkedIn.

KCCU is proud to announce they have been honoured for the third consecutive year as one of America's Best Credit Unions in 2026 by Newsweek, placing them in the top 500 credit unions in the nation!

This award recognizes KCCU's strong community impact and commitment to their vision of "providing financial opportunity, choice, and lifelong value to our members and our community."

Newsweek, in partnership with the market research firm Plant-A Insights Group, assessed over 8,800 banks and credit unions, obtained feedback from 66,000 U.S. customers, and evaluated over 82 million online reviews. In their results, they spotlighted the top 500 credit unions in the United States on Newsweek.com, and KCCU is honored to be named on this list! Credit Unions were highlighted in their own category as being recognized that they were a financial cooperative owned by their members.

Plant-A Insights Group based their assessment on factors of the financial institution's profitability, lending activity, overall financial health and stability, operational performance, and reputation.

"We are honored and thrilled to receive the American's Best Credit Union award from Newsweek for the 3rd year in a row! This award reflects our unwavering commitment to delivering exceptional value and service to our members, so they are empowered to achieve their financial goals," said Tracy Miller, CEO of KCCU. "We are deeply grateful for the dedication of our team and the continued trust and loyalty of our outstanding members."

"More than financial service providers, credit unions are community partners, showing up in neighborhoods, participating in local initiatives and helping strengthen the connections that bind their members together," said Jennifer H. Cunningham, Editor-in-Chief of Newsweek.

You can find more detailed information on Newsweek's website, America's Best Regional Banks & Credit Unions 2026.

###

Kellogg Community Credit Union, headquartered in Battle Creek, Michigan is a full-service financial institution serving people who live, work, worship, or attend school in the state of Michigan. With $951 million in assets, KCCU proudly serves over 55,000 members in Michigan, with branches in Battle Creek, Marshall, Kalamazoo, Portage, Richland, Grand Rapids, Schoolcraft, and Three Rivers. A community leader since 1941, KCCU consistently outperforms other financial institutions with outstanding service satisfaction ratings and a long history of growth. For more information, please visit www.kccu4u.org. Connect with KCCU on Facebook, Instagram, and LinkedIn.

Throughout the winter months, you’re either saving up for holiday gifts or trying to recover from them. Financially, things might feel a bit tighter than usual, especially with ever-rising prices on just about everything. While winter gives you a good excuse to stay in and save money, it’s completely normal to feel bored and at a crossroads. Do you hibernate all winter to save cash, or do you splurge on $100 ski rentals at Boyne for one day of fun?

Luckily, KCCU is here to remind you that finding cheap winter activities in Michigan doesn’t have to be stressful. Whether you’re looking for fun with the whole family or planning something with friends, there’s plenty to enjoy during the Mitten’s snowy season.

Outdoor Activities

1. Peabody Ice Climbing - Looking for a chilling, adventurous experience that makes you feel like you’re on top of the world? Peabody Ice Climbing in Fenton, MI offers the chance to climb their 45-ft and 75-ft ice towers—perfect for both beginners and experienced climbers. It’s fun for the whole family, and day passes are $25 per person (rental gear not included).

2. Echo Valley - Get ready for a day full of excitement with Echo Valley’s snow tubing, tobogganing, and ice skating all for $25! Located in Kalamazoo, MI, you can experience sledding at a whole new level with quarter-mile toboggan runs that reach speeds of up to 60 miles per hour. If you’re looking for a longer ride, enjoy the tubing hill with a paved and heated walking path, or go ice skating throughout the park. No matter what you choose, you’re guaranteed to make warm winter memories.

3. Christkindl Market - From November 19th through December 23rd, Grand Rapids is hosting its third annual Christkindl Market. Explore a wide variety of delicious food, drinks, handmade gifts, and more, with 60+ vendors in attendance. Even if you’re not looking to buy anything, the Christkindl Market offers a warm, scenic, and festive environment to stroll through and enjoy.

4. Millennium Park - If you’re looking for an affordable place to ice skate, head to Millennium Park in Kalamazoo, MI. Admission is just $5, and skate rentals are $3. Enjoy being outdoors while taking in the city’s lively winter atmosphere.

5. Flurry of Fun - Held in Kalamazoo in February, Flurry of Fun is packed with winter activities at absolutely no cost. Enjoy a hot chocolate station, s’more station, mobile library, storytelling tent, winter golf, winter obstacle courses, snow toss, and more. It’s the perfect opportunity to bring your little ones for a magical day they won’t forget. More information on dates and pre-registration will be available in January.

6. Winter Wanderland - Downtown Battle Creek is hosting the Winter Wanderland event on December 6th from 2:00 p.m.–8:00 p.m. Explore the city while enjoying free horse-drawn wagon rides and a mini Polar Express train. You’ll also find holiday markets and artisan vendors throughout the event.

Indoor Activities

1. Crafting for Adults - If you’re searching for a warmer, lighthearted activity, Willard Library in Battle Creek, MI offers adult craft nights. They feature a variety of projects, one of them being a chunky-yarn snowman. Stay updated on their website as well as All Events – Battle Creek to see what’s happening throughout the winter.

2. Kalamazoo Institute of Arts (KIA) - Enjoy free general admission on Thursdays at the Kalamazoo Institute of Arts. Stop in to browse beautiful artwork ranging from paintings and ceramics to photographs, prints, and sculptures.

3. Improv Night - Get your giggles in this winter at Crawlspace Comedy Theatre in Kalamazoo, MI. On December 12th, Crawlspace is hosting an improv night for $15 per ticket.

4. Winter Book Swap - Visit Sit & Stay Winery on December 4th in Kalamazoo, MI for a cozy evening of reading, delicious wine and food, and friendly conversation. The winery offers a warm, welcoming environment—perfect for a low-cost night out.

5. Trivia Night - Test your knowledge for free at LFG Gaming Bar in Kalamazoo, MI. Trivia Night takes place every Wednesday at 7:00 p.m., making it the perfect mid-week pick-me-up. Bring friends or family to team up—or spark some friendly competition!

6. Marshall Indoor Flea Market - If you’re big into flea markets but not into cold weather, Marshall’s indoor winter flea market is calling your name! Browse local produce, baked goods, and artisan shops as a refreshing morning activity. Admission is free, so it’s entirely up to your budget how much you spend on goodies and gifts.

No matter which activities you choose this season, KCCU hopes you—and your wallet—stay cozy all winter long. Happy holidays from KCCU!

Kellogg Community Credit Union (KCCU) is proud to kick off our annual toy drive, bringing joy to children who might otherwise go without a gift during the holidays. Now in its 23rd year, KCCU continues this heartwarming tradition of collecting toys and gifts for local children in need.

This year, all KCCU branches are excited to support local organizations dedicated to bringing holiday joy to children of all ages - from infants to teens. We invite our members and the community to join us by donating new toys and games for kids up to 17 years old. For our teenage recipients, gift cards make a wonderful choice, giving them the chance to choose something special from their own wish list.

Donations can be dropped off at any KCCU branch from November 10th through December 13th, 2025. Please remember to keep the donated gifts unwrapped. By contributing a gift, you can help brighten a child's holiday and bring the joy of the season to families across West Michigan!

"At KCCU, the holiday season is a time to reflect on the importance of generosity and community," shared Tracy Miller, CEO of KCCU. "We are honored to once again host our annual toy drive, helping to bring joy and hope to children and teens during this special time of year. We invite our members and the broader community to join us in making a meaningful difference - together, we can help ensure the season is brighter for those who need it most."

###

Kellogg Community Credit Union, headquartered in Battle Creek, Michigan is a full-service financial institution serving people who live, work, worship, or attend school in the state of Michigan. With $925 million in assets, KCCU proudly serves over 54,000 members in Michigan, with branches in Battle Creek, Marshall, Kalamazoo, Portage, Richland, Grand Rapids, Schoolcraft, and Three Rivers. A community leader since 1941, KCCU consistently outperforms other financial institutions with outstanding service satisfaction ratings and a long history of growth. For more information, please visit www.kccu4u.org. Connect with KCCU on Facebook, Instagram, and LinkedIn.

The temperature is dropping, the leaves are falling, and the snow is on its way. These are all tell-tale signs of fuzzy sweaters, hot cocoa, and most of all, the holidays. The holiday shopping season is close to being in full swing. If you’re wondering how you’re going to pay for this frenzy of shopping while keeping your checking account in the black, you’re not alone.

The most important thing to remember is to plan ahead: Have a set spending amount for gifts, wrap, entertainment, donations, and travel.

Make a list and check it twice

If your finances are tight you might have to evaluate your gift-recipient list to stay in budget this year. Once you trim your list, make a holiday treat or handmade token for those who got the cut. It really IS the thought that counts.

Once you have your list complete, figure out a realistic amount to spend on each person. Jot down a couple of gift ideas in your price range for that person.

Try a budgeting app like Mint to keep your spending in check. You can use Mint for regular monthly budgeting, but it also allows you to allocate more funds for holiday purchases. Using graphs and reports, it shows how much you’ve spent and how it will affect your budget in the months to come.

The iSpending app uses charts to show your expenses and how much you have left to spend, while CashTrails allows you to separate your normal expenditures from special purchases like holidays and travel.

Shopping

Most people want to avoid crowds, so they may hit stores earlier in the season or shop online. Retailers are well aware of this trend and are offering pre-Black Friday sales and discounts.

Spreading out your holiday shopping over several weeks also makes it easier on your budget. Always shop with a list and keep track of your spending. As you buy your gifts, subtract from your total budget.

In addition to shopping the sales and collecting coupon codes for online purchases, know when to buy. December is the best time to buy cars, appliances, winter clothing, and electronics. Also, know how much items cost before a markdown to know if you’re really getting a deal.

If you’re shopping online, order early and expect delays in shipping. Increased shopping during the holidays will affect already-strained delivery companies. To avoid shipping delays and higher shipping costs, shop at stores that offer “buy online, ship to store” service. This service is free at most retailers, some of which offer curbside pickup.

Get the best deals on cards, decorations and gift wrap during the days right before and after Christmas. Discounts of up to 75% off can shave a lot off your holiday budget for next year.

Entertaining

The best part about the holidays is getting together with your loved ones to enjoy each other’s company, which of course, can still be just as delightful when following a budget. If you’re hosting guests, keep costs down by asking everyone to bring their favorite side or dessert and include festive recipe cards with the chef’s name.

Use DIY decor featuring natural items, like holly and pinecones. Gather the kids and go on a hike to find outdoor holiday decorations. Not only will it save you money, but it will also give you some stress-free outdoor time with your family.

Travel

If you must travel home for the holidays, don’t forget to figure in other incidentals beyond gasoline and the cost of a plane ticket.

If you’re traveling by car, gas prices have luckily seen a steady dip. Still the GasBuddy app can help you find the best prices for gasoline wherever you are. Don’t forget to figure in tolls and any emergency costs that may come up.

If you’re flying, consider baggage fees, parking and shuttle costs and the expense of ground transportation once you arrive.

And don’t forget Fluffy! You’ll need to pay someone to take care of your furry friends. The Rover app can help you find pet care options near your home.

Charitable giving

The holidays are a time for goodwill toward all. But if your budget cannot accommodate a monetary donation, volunteer your time. If you can make a financial donation, be sure to check that the charity you are supporting is legitimate.

Keep your holiday dollars in check, and you may have some holiday spirit left over even after the last elf is packed away and the January bills start rolling in.

We at KCCU wish you all a happy, healthy and stress-free holiday season!

On October 16th, we celebrate International Credit Union Day - a time to recognize the vital role credit unions play in supporting their communities and helping individuals achieve their financial goals. For 77 years, this day has honored credit unions for their commitment to people over profit, offering personalized service, financial empowerment, and genuine responsiveness to members' needs. As we mark the milestone anniversary, we acknowledge the impact credit unions continue to have across the country in advancing financial literacy, inclusion, and building stronger, more resilient communities.

History of Credit Unions

The idea of credit unions first began in Germany during the 1850s, where early models were created to provide various financial services to communities that were excluded from traditional banking systems. Pioneers such as Friedrich Willhelm Raiffeisen and Hermann Schulze-Delitzsch were a key part of creating cooperative financial institutions that accentuated self-help and community collaboration. These institutions went against the practice of usury and aimed to provide affordable loans to rural and urban populations.

In North America, Alphonse Desjardins founded the first credit union in Canada called Caisse Populaire de Lévis in 1900. Consequently, this model inspired the first credit union in the United States, St. Mary's Cooperative Credit Association, in 1909, located in Manchester, New Hampshire. Desjardins sparked innovative groundwork for credit unions in America, further pushing for cooperative banking among local communities.

Credit Unions began to flourish with the Federal Credit Union Act of 1934, which provided a legal framework for federal credit unions and granted access to operate across state lines. This legislation was a key component in expanding credit unions and further ensuring their reliability during economic hardships, such as the Great Depression.

During the 20th Century, the seeds of credit unions blossomed from small, community-focused organizations into significant figures in the financial landscape, allowing them to serve millions of members. Credit unions became known for prioritizing their members by offering lower fees and better interest rates compared to traditional banks. Additionally, industrial unions contributed to the establishment of credit unions fitted for the financial needs of workers in various industries.

Credit Unions and Banks - The Difference

You may be wondering what makes a credit union stand out compared to a bank. While they're both financial institutions, there are various components that set them apart. For starters, credit unions are non-profit institutions owned by their members, while banks are for-profit institutions owned by shareholders. This leads to a difference in services, fees, and interest rates. Since credit unions are owned by members, any profits are returned to members through lower fees and better interest rates on loans and savings accounts. Conversely, since banks are for-profit, either privately owned or publicly traded, they aim to maximize profits for their shareholders. This can lead to higher fees and lower interest rates on savings accounts.

Furthermore, credit unions often emphasize community involvement and customer service, leading to a more personalized financial experience. Banks may also engage in community efforts, but their primary focus remains on profitability and shareholder returns.

How to Celebrate International Credit Union Day

If you want to join the fun and celebrate International Credit Union Day, there are several ways to contribute your support:

1. Talk about your credit union experience: Share your stories and successes you've had with your credit union through word of mouth, social media, or online reviews. This will inspire others to explore what financial options they have.

2. Promote financial literacy: Support financial education through sharing knowledge and resources with others, especially the youth, to empower them with financial skills.

3. Join KCCU on October 16th at your favorite branch for Credit Union Day and grab some giveaway items and refreshments! We invite everyone to join us for this celebration, as it recognizes our team for their dedication as well as our members who inspire us to strive for community cooperation and financial well-being every day. We hope to see you there!

Happy International Credit Union Day!

Looking to buy a new car, home, or just wanting to take a trip somewhere to escape from the cold weather, but it feels unattainable? Or maybe you're wondering, where is all my money going? Saving your money can often feel like running on a hamster wheel - you're trying to get somewhere but staying stagnant at the same time. Luckily, this month is all about savings and what you can do to better prepare yourself financially for the future. Financial Planning Month provides the opportunity to assess what you're really spending your money on, what you can do to cut costs, and how you can create simple plans that add up over time.

Additionally, with holidays right around the corner, giving yourself a month to analyze and prepare for the upcoming season sets an ideal timeline to establish new goals and review your finances.

How to Get Started

There are simple ways to cut back on spending, and as we all know every dollar counts. Making small steps toward a better financial state will result in making better financial decisions in the future. It gives you the ability to practice the art of responsibility and thinking ahead.

Make it a Challenge Without being a Challenge

When it comes to saving money, why not make the challenge creative and fun? The 100 envelopes savings challenge asks you to take a certain amount out, whether it be $25, $50, or $100, from each paycheck and store it in an envelope for a certain amount of time. If you store your money away in small amounts, you'll have a second savings in no time. Normally, it shows the amount of money that should be saved by the time the challenge is done, and voila! You have a few thousand dollars to put towards that dream vacation you've been dying to take.

Or take advantage of our Save to Win saving account! This unique account combines the benefits of a regular savings account with the exciting opportunity to win big! For every $25 deposited into your Save to Win account, you earn an entry into monthly, quarterly, and annual cash prize drawings.

Additionally, there are various challenges that can spice up saving money, one being a group effort. Have your friends or family join you in creating a goal amount to save up by a certain date. This turns saving money into a fun and friendly competition that gives motivation and accountability. After all, who doesn't like a little competition?

Join a Trade & Swap Group

The old barterting system is still alive today and promotes a sustainable lifestyle all the while saving money on things you desire. There are groups you can participate in within your local or online communities that allow you to trade things you no longer need for things you want. You're basically receiving free stuff and cleaning out your space of unnecessary items at the same time. That's what we call a win, win!

Cut Back on Social Media

Believe it or not, reducing your screen time actually helps save money. These days, the internet is filled with targeted advertising, and the seemingly cheap items on your Amazon wishlist add up quicker than you think. However, if you are an avid social media user or enjoy your online shopping, there are ways to still use both while managing your savings:

1. Set a budget for online shopping so that you can still enjoy spending while not breaking the bank.

2. Mute accounts that tempt you to make impulsive purchases. This helps reduce the urge to use an all-too convenient site for buying items.

3. Curate your feed to align with your goals, such as muting tempting accounts while following content that encourages financial responsibility.

4. Get rid of unused subscriptions. Look at how much money is being taken out of your account each month and where it comes from. After all, three unused subscriptions at $10 a month are $360 a year you could be saving.

See Where all the Green Goes by Evaluating and Budgeting

It might feel like you don't spend your money on a lot, but everyone has guilty pleasures in life that can lead to your bank account hurting. For instance, the iced coffee that you grab every morning might not seem like a big deal, but do the math for a year, and you'll start to see what you could be cutting out for a cheaper alternative. During the month of October document everything you spend, so you can see where your money goes and then using that information you can create a budget to help you save in the future.

Meet with a Financial Consultant

At KCCU, our investment team is prepared to meet you where you are, addressing your specific needs and financial goals. If you're looking to secure yourself financially in the long run, our financial consultants are here to help you get on the right path to ensure that you can feel secure in your financial position and future. When it comes to our members, we strive to work side by side to build a desired financial lifestyle.

There are many avenues to take when it comes to planning out your financial goals and saving money. As stated, planning for a desired financial position can seem daunting, but the sooner you focus on your future, the more stabilized your future will be. Our team at KCCU is rooting for you this month, and we hope that you succeed in what you seek. Happy Financial Planning Month!

Kellogg Community Credit Union (KCCU) is thrilled to announce the winners of its recent home equity promotion, OMG (Oh my gosh) My Home Equity Loan is Free? Raffle. The Raffle ran from June 1 - August 31, 2025. Everyone who opened a new fixed rate home equity loan or home equity line of credit of $20,000 or more were automatically entered into the drawing for a chance to have their loan paid off, up to $25,000.

KCCU members, Melanie & Clint have been named the winners of the 2025 OMG! My Home Equity Loan is Free? Raffle! A celebration took place at KCCU's B Drive Branch in Battle Creek, where team members gathered to congratulate the long-time members. Melanie and Clint were stunned when they received the surprising news—and even more so when they saw the check made out in their name.

"When the KCCU team called us to let us know we had won, we couldn't believe it happened to us," said Melanie. "It is a huge blessing for sure. To be able to pay off our loan sooner than expected is really exciting. We are so grateful to have won this!" She continued, "KCCU has always gone above and beyond for us to make our dreams come true. We've purchased homes that needed remodeling and presented challenges, and the lenders always got us what we needed when we needed it. KCCU has always been so good to us."

"We always look forward to our 'OMG!' Raffle with great excitement," said Tracy Miller, CEO of KCCU. "It's incredibly rewarding to give one of our members up to $25,000 to put towards paying off their loan. Seeing their reaction when they walked through the doors to claim their prize was unforgettable. Moments like these truly remind us why we do what we do at KCCU. We're proud to support our members on their financial journeys and honored by the trust they place in us. Being able to make a meaningful difference in our members lives is what it's all about."

To check out the video capturing the surprise, visit KCCU's website, www.kccu.org.

Photo caption: Pictured are KCCU Team members celebrating with OMG! Raffle winners, Melanie and Clint, who are in the center holding the prize check.

###

Kellogg Community Credit Union, headquartered in Battle Creek, Michigan is a full-service financial institution serving people who live, work, worship, or attend school in the state of Michigan. With $931 million in assets, KCCU proudly serves over 54,000 members in Michigan, with branches in Battle Creek, Marshall, Kalamazoo, Portage, Richland, Grand Rapids, Schoolcraft, and Three Rivers. A community leader since 1941, KCCU consistently outperforms other financial institutions with outstanding service satisfaction ratings and a long history of growth. For more information, please visit www.kccu4u.org. Connect with KCCU on Facebook, Instagram, and LinkedIn.

Do you ever feel like managing your money is a full-time job? Between paying bills, remembering due dates, and waiting in line to deposit checks, it's easy to feel overwhelmed. Fortunately, there's a simple solution that can save you hours every month and reduce financial stress: automating your payments and deposits. Let’s break down how this works.

What are Automatic Payments and Deposits?

Automatic payments and deposits are financial tools that allow money to move in and out of your account without you having to manually do anything each time. These systems use your bank routing number (a nine-digit number that identifies your bank) and account number (your personal bank account) to securely move money.

With these two numbers, you can:

· Set up direct deposit of your paycheck, government benefits, or other regularly scheduled deposits.

· Quickly move money from payment systems such as Venmo, PayPal, Cash App, etc. to your account.

· Authorize automatic bill payments for utilities, rent, loans, subscriptions, and more.

How to Set Up Automatic Payments and Deposits

Whether you want your paycheck to go directly into your account or have your gym or utility bill automatically deducted from your account, all you need is KCCU’s routing number and your full account number.

KCCU’s routing number is 272476734. Our routing number can be found on multiple locations on our website, including in the footer, on the Contact Us page, and within online banking.

Your full account number can be obtained by stopping into a branch or by conveniently accessing it within your secure online banking account. To view your full account number from online banking, follow these easy steps:

1. Log into online banking.

2. Go to the main “Account Summary” screen.

3. Find the account you want the account number for, then click on the three dots (…) to the right of your balance.

4. Select “Account Details” from the menu options.

5. On the next screen, click the “More Account Details” button and your full account number and the routing number will be in the “Account Information” section.

Tips for Managing Automated Finances

- Timing is important: Payments coming into your KCCU account via ACH can take a few days to process, so check your balances before spending. KCCU does accept Real-Time Payments (RTP), a U.S. payment system that allows funds to move instantly between domestic financial institutions. KCCU is currently able to accept incoming RTP, but members cannot send funds via RTP from their KCCU accounts. To see if a payment is coming via RTP, check with the vendor who is sending the payment.

- Keep a Buffer: Maintain a cushion in your account to cover unexpected charges.

- Check Monthly Statements: Automation isn’t “set and forget.” Stay aware of your transactions.

- Use Alerts: Set up low balance alerts or payment confirmations with your bank.

Final Thoughts

Automating your finances might be the simplest way to buy back your time, reduce stress, and take control of your money. All it takes is a few pieces of information and a little setup time.

For most Americans, retirement is a sought-after dream that offers the ability to break free from financial worries and instead focus on enjoying the world around them. It could look like buying a condo somewhere sunny or just kicking your feet up on a reclining chair to soak in some relaxation. No matter what retirement looks like for you, it’s necessary to plan ahead of time to ensure that your retirement savings align with your dreams and goals.

National 401(k) Day, September 5th, serves as an opportunity to check your retirement reserves and get started on planning an ideal future. While most employers offer a 401(k) plan, less than half of Americans choose to invest. It might seem daunting to set aside cash from your paycheck, because most individuals want their full check upfront, but investing in a 401(k) plan means investing in your future self.

History of 401(k) Day

The 401(k) plan stemmed from the Revenue Act of 1978. An arrangement was made to allow employees to postpone compensation from stock options and bonuses without immediate taxation. This condition was listed in Section 401(k) of the Internal Revenue Code, which was designed to limit tax-advantaged profit-sharing plans that, in return, would result in benefiting executives. However, Ted Benna, a benefits consultant, saw the potential of this provision to create expansive retirement savings for employees. In 1980, Benna implemented the first 401(k) plan for his company, The Johnson Companies.

In 1996, National 401(k) day was established by the Profit Sharing/401(k) Council of America. The holiday was created to raise awareness of retirement savings education and motivate Americans to start their 401(k) plans. This day takes place on the Friday after Labor Day intentionally so that individuals can start the week with Labor Day and end the week with retirement.

Why You Should Invest in Your 401(k)

There are several benefits to investing in your 401(k), including tax advantages, employer matching contributions, and compound interest. Tax benefits result from your 401(k) because the contributions are made pre-tax, basically meaning they reduce your annual taxable income. This results in your money becoming tax-deferred until it is withdrawn in retirement, potentially reducing your overall tax burden.

Several employers are willing to match contributions to your 401(k). In other terms, employers offer free money so that you’re able to save up for your future while still getting paid a percentage for your contribution! If your employer offers this opportunity and you decide to decline, it’s almost like declining an extra amount of cash.

Compound interest is another benefit of investing in a 401(k). You earn interest on the initial investment in addition to the interest that accrues over time, ultimately increasing your savings substantially. The earlier you choose to invest in your 401(k), the more you can benefit from compound interest.

Lastly, your 401 (k) protects you from early withdrawal. Some may see having penalties for withdrawing before age 59 ½ as a downside; however, it helps you refrain from using the money for anything other than securing your future. It can assist you in resisting the temptation to take from your retirement savings for non-emergency expenses, ensuring that you stay on track for a secure and blissful retirement.

KCCU values each and every one of its members and their long-term goals for retirement. Along with deciding to invest in a 401(k) account, KCCU offers individual retirement accounts. An individual retirement account (IRA) is a type of savings account designed to help you save for retirement and offers tax advantages.

KCCU offers several options for IRA accounts to meet your needs, including both Traditional IRA and Roth IRA accounts. Additionally, we offer an IRA Certificate Account where you get the tax advantages of a traditional IRAs with the added benefit of higher returns from a Certificate Account.

Investing in a 401(k) account can seem intimidating or unnecessary for some, but the bottom line is that putting aside some money from your paycheck will give your retired self stability and peace. National 401(k) Day is your friendly reminder that paving the way for a financially secure destiny can start in the present; your future self will thank you.

Kellogg Community Credit Union (KCCU) will kick off its annual coat drive on September 15 to help the members of the communities they serve stay warm this winter. The coat drive will run until October 31, and items can be dropped off in the lobby at any KCCU branch location. Financial hardship can make it difficult for some families and individuals to ensure they are dressed properly this fall and winter, making this annual coat drive especially timely. KCCU knows their team, members, and the community will come together and show support for this worthy cause, as they have done for many years past.

KCCU is committed to helping provide cold-weather gear for those who may need assistance, so they are collecting new and gently used coats, snow pants, hats, mittens, and scarves that are clean and in good condition, in all sizes from adults to infants and everything in between. The items collected will be distributed to local families in need by community partners.

"KCCU is deeply committed to supporting the communities we serve in every way possible," said KCCU's CEO, Tracy Miller. "With the colder months just around the corner, we want to make sure everyone in our community has access to warm clothing. Our annual Coat Drive is one of the many ways we strive to give back and embody our 'people helping people' philosophy. Together with our incredible community partners, we're honored to make a positive difference for families and individuals who may need a little extra help as the cold weather approaches. A heartfelt thank you to everyone who donates and helps us make a lasting impact!"

KCCU's vision statement includes, "providing opportunity and lifelong value to our members and our community." KCCU takes this statement seriously, and for the past twenty-one years, they have hosted a Coat Drive in partnership with community-based organizations as part of their commitment to their vision.

###

Kellogg Community Credit Union, headquartered in Battle Creek, Michigan is a full-service financial institution serving people who live, work, worship, or attend school in the state of Michigan. With $928 million in assets, KCCU proudly serves over 54,000 members in Michigan, with branches in Battle Creek, Marshall, Kalamazoo, Portage, Richland, Grand Rapids, and Three Rivers. A community leader since 1941, KCCU consistently outperforms other financial institutions with outstanding service satisfaction ratings and a long history of growth. For more information, please visit www.kccu4u.org. Connect with KCCU on Facebook, Instagram, and LinkedIn.

Did you know approximately 102 million American adults need life insurance or more of it? September is Life Insurance Awareness Month, a time to consider your life insurance plan — whether you currently have one or don't. Life can move fast; American families are trying to work through their day-to-day responsibilities to provide for their children, and many times a life insurance plan may get overlooked, or household providers are unknowingly underinsured. For anyone who has dependents or loved ones they want to care for after passing, life insurance is a necessity that ensures lost income doesn't translate into tangible material losses once you're gone. Life Insurance Awareness Month gives you the opportunity to assess whether your plan is right for you and your loved ones, or if you need to change or start a new plan.

History of Life Insurance

The idea of life insurance can be traced back to ancient Rome, where soldiers formed “burial clubs.” Members would contribute to a fund that covered funeral expenses for those who passed away, which would ensure proper burial rites. Similar practices also existed in Egypt to reflect the importance of respect for one’s funeral. Later, during the Middle Ages, guilds were established as a form of insurance to offer financial assistance in times of need, such as rebuilding after disasters or covering funeral costs.

In 1583, modern life insurance was born when Richard Martin, who purchased the world’s first recorded insurance policy, insured a man named William Gybbons for a total of £400 in the event of his death within the year. Years later, in 1706, the Amicable Society for a Perpetual Assurance Office was established in London. This marked the first modern life insurance company where members paid annual contributions and benefits were given to families with deceased members.

In the 18th and 19th centuries, life insurance began to gain popularity in America. In 1759, The Presbyterian Church began offering life insurance to the clergy which eventually evolved into formal life insurance models. Additionally, the demand for life insurance dramatically increased during the Civil War, leading to a tripling of life insurance coverage during the years of the war.

How Do I Know if I'm Underinsured?

Let’s discuss five different circumstances, according to Life Happens, that raise the possibility of being underinsured.

The first is if you only have life insurance through your employer. Life insurance plans offered by your employer typically offer very limited coverage, such as a year or two worth of salary. If you have any significant debts or plan of providing college education to loved ones, it’s unlikely that your employer’s plan will meet your family’s needs. Additionally, life insurance provided through your employer is normally only available while you have the job; If you must leave your job for any reason the coverage will no longer apply.

The second circumstance is if your income has increased. We can all celebrate a raise, as it is an important landmark at our jobs and means more money. However, if you are making much more income today than when you first bought your life insurance policy, it is possible that you are underinsured.

Third, you may be underinsured if your stay-at-home spouse doesn’t have a life insurance policy, and if so, it’s necessary to start thinking about getting them one. Even if your spouse isn’t making income that would need replacement, they may be paying for childcare or other services that would need to be paid for if they were to pass.

Speaking of children, you might be underinsured if you had a child. Your life insurance policy needs differ significantly once you decide to bring a child into the family, as children can be extremely expensive. In 2025, it is estimated that raising a child costs about $30,000 per year from birth to age 17. Therefore, it is worth looking into your current plan to ensure that your child can get all the necessary resources.

Lastly, the fifth circumstance that can alter your life insurance policy is buying a new home. Paying a mortgage is one of the biggest investments we make during our lifetime and may be unattainable for your family if you were to suddenly pass. If you bought a new home since setting up your life insurance policy, you might find that you need more coverage to make sure your family will be able to pay off the debt.

If you are looking to start a life insurance plan or wondering if your policy is right for you, KCCU’s investment team is here to help you get started. Our financial consultants offer a holistic approach and specialize in several areas within wealth management, including life insurance. KCCU wants nothing but the absolute best for its members; we’re here to ensure that your future financial health is in good hands and can be distributed to your loved ones.

Life Insurance Awareness Month is an opportunity to reflect what you wish for your family or loved ones’ financial position to look like if you were to pass. Investing in life insurance means investing in the people you care for. If you have not signed up for a plan or are unsure about your current plan, this month is your chance to set you and your loved ones up for financial success.

Picture this: You’re at a higher-end retail store where you occasionally pop in just to peek, not because you plan on buying anything but because you simply like to admire the chic and overpriced articles of clothing. Suddenly, a pattern of stripes with flashes of your favorite color catches your peripheral vision. You whip your head around to discover the most stunning cashmere sweater that you’ve ever laid eyes on. You’ve heard stories and seen them on social media, but you never thought it would be in your grasp. Slowly, you flip over the price tag, preparing for it to sting, but to your surprise, it’s 50% off. You whisper to yourself with a wide grin on your face, “What a bargain.”

We’ve all come across an unbelievable bargain at some point in our lives, whether it was the perfect centerpiece that tied the dining room together, a new set of tires you needed to face the harsh winter, or a juicy find on Facebook Marketplace. Regardless of the bargain, a good deal never fails to leave us with that rush of serenity and satisfaction.

Starting today, we can all celebrate the feeling of saving money with National Bargain Hunting Week. National Bargain Hunting Week is observed each year during the second week in August. This week is devoted to all the bargain battlers, savings soldiers, and coupon connoisseurs.

History of National Bargain Hunting Week

National Bargain Hunting Week was established in 1996 by Debbie Keri-Brown, an author and passionate bargain shopper. The holiday was paired with her books, Bargain Hunting in Ohio and Bargain Hunting in Columbus. Not only did she create the holiday, but she placed National Bargain Hunting Week on the same dates as National Smile Week. Debbie understood that bargain hunting gave people great joy, therefore, she intentionally chose to have the two weeks coincide.

How to Celebrate National Bargain Hunting Week

There are several ways to celebrate this exciting period, but the biggest factor to National Bargain Hunting Week is being able to shop and leave with a full wallet. You can start off by shopping at local stores to browse any good deals that may be available, but exploring second-hand stores that you haven’t visited or searching for yard sales can spice the experience up. Additionally, bargain chains such as Burlington Stores and Ollie’s are known to celebrate by offering extra savings during this week.

While some prefer to bargain hunt solo, it could also be an opportunity to gather a group of friends and head out to shop for the day or weekend. Combining ideas on where to hunt for deals creates a much better chance of finding the hidden gems you’re searching for. Not only that, but it can serve as an enjoyable experience that creates a fun and thrilling memory.

Lastly, National Bargain Hunting Week could be a time to buy those you care about gifts of appreciation. Buy your coworkers fun office supplies or search for heartfelt items to give to family members or friends. Not only do you potentially get to steal some deals, but you can share the love when pursuing this joyful holiday.

National Bargain Hunting Week is a time of spending (less than expected), saving, and smiling. Whether it is spent at your local stores, second-hand shops, or garage sales, we hope that you set forth on your bargain hunting journey this week and find some personal diamonds in the rough. Happy hunting from KCCU!

An excellent credit score is the ultimate goal of the financially responsible consumer. Those three magic digits tell a story of accountability, good financial sense, and the ability to spend mindfully. A great credit score also unlocks doors for large, affordable loans, employment opportunities, and more.

Its significance notwithstanding, achieving and maintaining an excellent credit score is easier said than done. There is no quick and easy way to dramatically boost your score over a short period of time, but you can take steps to increase your credit score gradually. First, you must know your score. KCCU offers a free service where you can find out yours: SavvyMoney®! Below, we’ve listed six ways you can start amping up your credit score today.

1. Pay your bills on time

Your payment history is the single most important factor in determining your score. A missed credit card payment can significantly impact your score, and it can take months to recover from the loss. Set a reminder a few days before your bill is due to ensure you never miss a payment. You could also set up recurring payments from another one of your sub accounts (AFT – Automatic Funds Transfer), or from another institution (ACH – Automated Clearing House). At KCCU, we have many different options for you to make a loan payment!

2. Reduce your credit utilization ratio

Another crucial factor in your score, your credit utilization ratio, refers to the amount of available credit you use. It’s best to keep your utilization under 30%, or even 10% if you can swing it. This means, if you have $50,000 of available credit, try to keep your usage below $15,000 at most and, ideally, below $5,000. It can also be a good idea to accept offers of increased credit or to request an increase on your own, which can instantly bring down your credit utilization ratio. However, only go this route if you know you are not at risk of overspending as soon as you have more credit at your disposal.

3. Use your cards

Taking a pair of scissors to credit cards can seem like the perfect way to increase your credit score, but you need to use your cards to keep your score high. A great way to make sure you use your cards occasionally but don’t overspend is to charge fixed expenses, like monthly subscriptions, to your card. Just be sure to pay the balance in full before the credit card bill is due. If you’re in the market for a new card, be sure to check out our KCCU Visa Credit Cards! We offer an Edge and an Elite credit card, both of which can be eligible to earn rewards – either points redeemable for merchandise, travel, and gift cards, or cash back. If you’re going to use your cards, you may as well earn rewards along the way!

4. Work to pay down outstanding debt

If any of your cards are carrying a balance from month to month, showing that you are working to get rid of this debt can do wonders for your credit score. Maximize your monthly payment by trimming an expense category in your budget and channeling that extra money toward your credit card bill. Don’t be afraid to reach out to your credit card company to ask for a lower interest rate as you work to pay off debt. Finally, consider consolidating credit card debt with a personal loan, which will help you eliminate your credit card debts and leave you with one low-interest payment to make each month. Stop into your local branch if you are looking into debt consolidation options. Our Member Service Representatives are happy to help!

5. Look for errors on your bill and credit history

A fraudulent charge on your credit card can bring down your score without your knowledge. That’s why it’s important to check your statements each month and to look for charges you don’t remember making. If you see anything suspicious, contact the credit card issuer immediately to dispute the charge. It’s also a good idea to get your annual free credit report for a more comprehensive look at your credit usage and signs of possible fraud. With SavvyMoney®, you have access to your full credit report, credit monitoring alerts, tips to improve your credit score, and more!

6. Become an authorized user on another cardholder’s account

If you’re new to the world of credit, and you’re looking to thicken your credit file to build your score, becoming an authorized user on another cardholder’s account can be a great way to get results quickly. Partner with someone who has excellent credit and a strong payment history to help ensure every bill is paid on time. Your partner’s responsibility will reflect well on you, helping to build your credit history and boost your score. Credit scores are a crucial component of financial wellness, but achieving and maintaining a high score can be challenging. Use the tips outlined above to start boosting your score today. What are you waiting for? Check out SavvyMoney® in your KCCU online banking today!

For parents with college-bound students, helping them feel at home in a new environment is a top priority—especially when it comes to furnishing their dorm room. While students may dream of a cozy, stylish space, many families are also working within tight budgets. The good news is, it’s entirely possible to create a comfortable and personalized dorm room without overspending. With a little creativity and effort—like repurposing items from home, shopping secondhand, or taking advantage of student discounts, your student can achieve a space that feels like home while staying well within budget. Below are some tips to get you started!

1. Set a budget

Like all major financial undertakings, furnishing and decorating a dorm room requires planning ahead and establishing a budget. Make a list of everything needed, and then determine how much money it will take to cover all costs.

You’ll also want to take some time to choose what is most important to you, deciding where to spend more money and where to rein in the spending. This way, you can shop stress-free, knowing you’ll have enough funds to cover all necessary expenses and won’t wind up with a half-decorated room or missing some essentials.

2. Shop second-hand

Thrift stores are your new BFF. Hit up shops like Goodwill and the Salvation Army for used furniture treasures, creative decorations, and so much more. Shop with an open mind and remember that a small facelift—like a fresh coat of paint or new accessories—can help you customize any bargain-priced piece of furniture you find.

3. Get creative with storage

Dorm rooms are not typically known for being big on space. Ensure you have sufficient storage in your dorm room by having your furniture multitask. Think ottomans that open up to provide you with room forbooks, under-the-bed storage bins, and more. You’ll have space for all your stuff without making your room look overstuffed with storage shelves and hooks.

4. Use removable decals

Personalize your space and add color to your walls with removable decals. You can find them online and in home décor sections of big-box stores, and most are inexpensive. Removable decals are a great way to turn your dorm room into your own space, as they come in a wide variety of colors and styles. If you like to hang up clever one-liners on your walls, you’ll find those in decals, too. They’re also super easy to hang up and can be removed with very little effort and without damaging your walls.

5. Shop the sales

Save a boatload on your dorm décor by shopping sale events throughout the year. For example, shop department stores at the beginning of the year to take advantage of January’s “white sales” for bedding and linens. You can also pick up that dream piece of furniture you’ve been eyeing when furniture prices drop in February, and shop from Black Friday through December for all sorts of dorm essentials like mini fridges, blenders, and coffeemakers at bargain prices.

6. Recycle and upcycle what you already have

Upcycling—or reusing old materials to make them more functional—and recycling are perfect ways to get your dream dorm room without spending a whole lot of money. Look through your belongings to find things you barely use or were about to toss, and find ways to repurpose them for your dorm room. For example, you can clean out a used tin can, decorate it with Washi tape and use it as a catch-all for your writing supplies. old picture frames can be painted and refreshed to match your new décor, or use your holiday lights to hang to add ambiance to your room.

Decorating your dorm room does not have to drain your wallet or force you to compromise on your personal taste and style. Use the tips here to create your dream dorm room on a budget.

July 1st marks a day closer to celebrating Independence Day for many, but what others may not know is that this day serves as an important step in creating a desired financial lifestyle. Financial Freedom Day strives to raise awareness about making the American dream even dreamier. On this day, freedom refers to the ability to build a sustainable amount in savings and obtain passive income so that one does not need to worry about steady employment. Financial freedom provides the choice to live out passions and goals outside of work, whether it be traveling around the world or achieving early retirement.

The History Behind Financial Freedom Day

Financial freedom begins with personal finance —the financial management done by an individual or an entire family. It entails budgeting, saving, and spending money. In 1920, the first research done on personal finance was conducted by Hazel Kyrk who laid the foundation for both family and consumer economics. In 1947, Herbert A. Simon claimed that most individuals may not be able to make good economic decisions due to limited educational resources and personal desires. Thus, through several studies it was concluded that personal financial education was necessary for sound financial decisions. After 1990, several universities began offering financial education courses.

In 1984, the Association for Financial Counseling and Planning Education (AFCPE) was founded at Iowa State University, and the Academy of Financial Services (AFS) was established in 1985. Both became extremely influential institutions in personal finance. Furthermore, in 2008, the United States President’s Advisory Council on Financial Capability was established to further promote financial literacy in America.

How to Accomplish Financial Freedom

Financial freedom truly is a dream that can be turned into reality. However, it does require discipline, consistency, and strategy. Along with achieving passive income and strong savings, it involves paying off debt or reducing loan costs. Many start paving the way for financial stability with small habits such as setting life goals, creating automatic savings, and making a monthly budget.